Is your major store closure scare just behind you, or is it yet to come? Think about developing your retail lease management!

Doing business in highly competitive markets, experiencing the deterioration of margins and heavy brand over distribution, as well as exit and rent reduction projects have become a necessity, even for well-known fashion retailers.

It’s no secret that in addition to personnel expenses, leasing costs cut up to 20% off retailers’ revenues. This share gets closer to 25-30% if you expand your scope and examine your store occupancy costs.

Hugo Boss, another brand that just went through a major store closure program (photo: Brand Pilots)

After a Retail Lease Management Project Is Only a Breath Away From the Next Reshaping

From recent projects that have successfully reshaped store portfolios and leasing costs, I know that retailers are happy to praise the EBIT effect but then quickly lose interest and return to focusing on their core business. A prudent CFO, however, would ask questions that go beyond the one-off lease management project, such as:

- How can we preserve the effect into the future?

- How could I tightly manage my store occupancy costs, not only when negotiating the lease?

- How could an efficiently managed lease portfolio support our EBIT line?

- How could we increase the flexibility of our leased portfolio to meet our future demands for stores in a dramatically changing retail world to align with our customer base (re-sizing/ relocation/ duration/ levels/ storage/ no of stores/ subletting/ et al.)?

It is my experience that under the current market pressure all aspects of leasing, operating and makeup of the portfolio will attract continuous management attention – even where retailers can expect strong support for their EBIT line. CFOs would be well advised to be sensitive to this topic.

For department store closures become a standard process (photo: Brand Pilots)

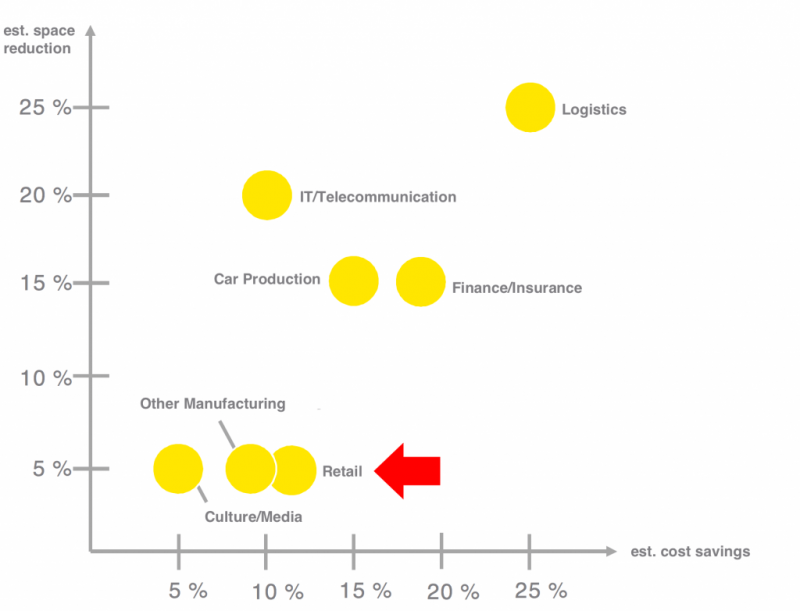

An earlier E&Y survey amongst listed German companies estimates that, in the retail business, an integrated property management (they call it Corporate Real Estate Management= CREM) could result in a 5% reduction in space and a 10% cost reduction. This can have a tremendous effect on a retailer’s P&L, but involves much more than only doing lease management.

Savings potential of integrated corporate real estate management (Source: adapted from E&Y CREM Analysis, June 2014)

Beyond Retail Lease Management for Brands? Breaking New Ground with Property Management!

Most lessors are doing real estate as their core business. For them, asset and property management are a necessity to manage their large lease portfolios and values. Well-known brands are mostly lessees and often rent and manage portfolios of up to several hundred stores. The total long-term financial obligation of such portfolios can quickly go beyond 50 -100 million €, yet retailers avoid a strong and integrated property management.

Good property management creates great store contributions (photo: Brand Pilots)

In most cases, brands do handle their expansion very professionally, but after signing the lease contract…

- Who will do the contract management, regearing lease costs as well as handling all issues arising during the life cycle of a lease contract?

- How is the claim management efficiently organised?

- Who will systematically go for the optimal facility management costs, particularly repair and maintenance, cleaning, e.g. for a defined quality?

- Who will provide a tough cost- and quality management for any outsourced service contracts?

Having experienced many projects, including from a retailer’s perspective, I can confirm that there is room for improvement. Think about your own property management processes, or just consider the following case: initiated by the expansion manager, the lessee claimed a damage (repair and loss of turnover). The lessee withheld a substantial amount of the lease payments. Claim and settlement attempts were handled by the accounting department in collaboration with high profile external lawyers. After 12 months of debate, a settlement was reached. The net effect for the retailer: they lost money because withholding lease payments was not admissible and had to be paid back. The damage was repaired at <3K € and paid by the insurance. Sunk profit couldn’t be proved, and lawyers’ cost by far exceeded the balance. The process wasn’t structured efficiently, nor logically, but turned out to be very expensive.

A retailer that could avoid major store closure programmes (photo: Brand Pilots)

Besides Store Occupancy Costs – Flexibility in Your Store Portfolio

Running through your store portfolio, you’ll find it a mirror of your brand’s historical development: a great diversity of store layouts and schemes experienced over years. Some of them may fit your current strategy, others may be too large or too complex to operate, resulting in major losses. But will a majority of these stores fit into your future strategy? The rapidly changing retail environment with increasing shares of online business will definitely have a great impact on store sizes, shapes and microlocations. Gaining flexibility and steadily reshaping your store portfolio becomes a competitive advantage, and that may be more valuable than reducing your occupancy costs. A strong, but not necessarily large, property management has to follow a retailer’s strategy to achieve advantageous occupancy costs as well as quality objectives.

It’s All About Transparency – Define and Manage Your Data Cloud

Almost every time I dug into a retailer’s property management data cloud, I experienced a bundle of data, mainly on excel sheets, showing key terms of the lease contracts. What has been common to all of them: inconsistent data, variations of the same data used by different departments, missing data such as other occupancy costs, the size and number of operated floors or key indicators making lease contracts comparable. Finding merged operating, retail and leasing data in one place, or gaining an insight into the retailer’s total store occupancy costs has been rare. Learn from these mistakes and get your internal data base transparent and well shaped, and establish professional property management tools that enable a strong management of your occupancy costs.

Integrate Reliable Market Data

It’s very annoying to learn that your competitor is opening a new store adjacent to your brand. But it’s even worse to hear, that they took advantage of the decreased rental level when signing a new lease shortly after you executed your extension option at an above-market rental level. The reasons for this: yearly CPI increase outperformed the development of market rents. Integrate reliable market data about current demand for stores and rent comparables in your property management system. This should be a ‘must’ and would definitely help you to make better decisions ahead of time. Yes, of course, market comparables and projections are not very transparently available. But it’s a common and well-established practice, even if you’re doing project development, and you should take advantage of this.

Promote Property Management in-house (photo: Urban Plattes)

Staffing Property Management – More Than a Cost Category

In the current market climate, brands try to shrink their overhead cost and impulsively cut administrative and labour costs when under pressure. In competitive markets, it may seem contradictory to call for quality staffing in property management positions. But managing lease contracts and occupancy cost are great challenges. Long term financial obligations ranging from 50 to several hundred million €, as well as substantial cost reductions, definitely require professional handling. Compared to retailers’ well-established finance departments, they haven’t been keen on demanding quality staffing of property management departments. Key competencies should cover the operating and facility management processes as well as expansion and contract management skills. Of course, you might consider outsourcing your property and lease management to gain more flexibility. While this may work well in some aspects, keeping management and know-how internal will be key to the success of your property management structure.

Think about achieving the next level of excellence by moving beyond expansion practice and retail lease management in your organisation! Don’t quite know how to get there? Please consider taking advantage of our valuable market experience.

Top picture: Store Closure (photo: Flickr Mike Kalasnik)